(404) 312-6640

In a Battle Between Preneed Trust and Insurance: WHICH FUNDING METHOD COMES OUT AHEAD?

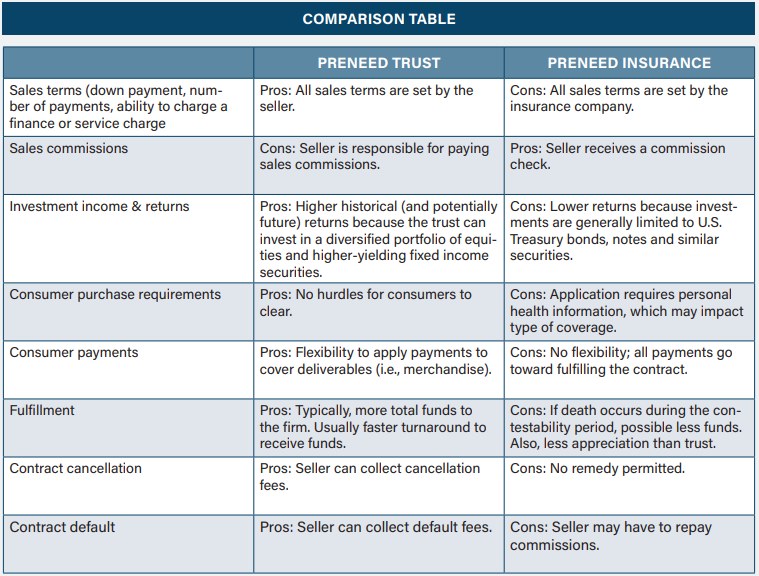

When exploring a funding method for your funeral home’s preneed program, you have two choices: trust or insurance. There are pros and cons to both that we will explore here.

The preneed trust-insurance debate is more pertinent than in years past given the recent economic climate. Stubborn inflation is increasing operating costs and, if not held in check, could impact the expense of delivering merchandise and services when a contract turns atneed. Funeral directors are searching for ways to protect operating margins, and trust contracts are appealing because they hold the potential for returns that outpace the cost of doing business. Here is a point-by-point overview of the pros and cons of each funding method:

SALES COMMISSIONS: INSURANCE VERSUS TRUST

Let’s cut to the chase regarding the biggest factor in the trust or insurance debate. Many funeral directors prefer insurance-funded over trust-funded contracts for one main reason: sales commissions. Business owners favoring trust contracts must foot the bill to pay for sales and marketing expenses: salaries/wages/ benefits for sales team members, advertising/promotion/travel and entertainment, and sales commissions (usually around 6% of the contract purchase price). Additionally (and this is important), in states that mandate 100% trusting, sellers using the trust funding method cannot use any funds from the contract sale to pay commissions. Sales of insurance contracts, however, generate sizable commission income (often averaging around 12% of the purchase price for paid in full contracts and 25% for multi-pay) for the funeral home which helps boost the business’s cash flow and offset up-front marketing and sales costs. Funeral homes may receive advance incentive payments from insurance companies, which also improves cash flow (the incentive arrangements are subject to claw-backs if the business does not meet predetermined volume or dollar value sales goals).

INVESTMENT INCOME AND RETURNS

This is where trust contracts shine because state and federal regulations provide the trustee with significantly more leeway to invest funds compared to proceeds from insurance sales. Preneed funds often are invested in a diversified mix of equities (around 40-60% of fund assets) and a blend of highly rated corporate bonds, U.S. Treasury bonds and notes, and money market securities. Over the past decade (through December 31), trust assets have generated annual returns of around 5 to 7%. As the oft-heard legal disclaimer goes, “Past performance is no guarantee of future results.” Still, history has proven that preneed trust investments have a statistically higher probability of outperforming inflation and fixed-income securities – and those extra returns are usually the difference between a profit or loss on a preneed contract. Insurance companies generally are limited in how they can invest preneed funds and are often required by law to invest in risk-free investments such as U.S. treasury notes and bonds. Over the past decade those returns were painfully low (around 1-2%). True, short- and long-term treasuries now are yielding 4-5%. Still, with funeral and cemetery operating expenses increasing around the same rate, there is not much left over that business owners can use to add to retained earnings and reinvest in their companies.

CUSTOMER PURCHASING REQUIREMENTS

One benefit that preneed trust sellers promote is that families are not required to disclose personal health information. Also, the total price paid does not vary from consumer to consumer based on the buyer’s health status. A limitation of insurance funding is that the purchaser must complete an application that includes questions about the health of the insured. The answers to those questions do not prevent the buyer from securing the insurance to fund the preneed contract, but the information provided is factored into the premiums that will be paid and the amount of the death benefit that will be received on policies issued for insureds with health issues. In some instances, the buyer may not qualify for certain types of coverage.

APPLICATION OF CONSUMER PAYMENTS

Trust contracts provide sellers the flexibility to allocate customer payments. For example, if the contract includes merchandise – where merchandise is required to be trusted at a lower percentage than services – a trust-funded contract permits the seller to allocate funds first to merchandise, allowing the funeral home or cemetery to retain more money early in the contract’s payment cycle. Insurance-funded contracts provide no flexibility and require that premiums be paid directly to the insurer.

LICENSING REQUIREMENTS

In just about every state, regulations mandate that the funeral home and its sales reps be licensed to sell preneed trust and/or insurance contracts. With insurance products, however, there is another hurdle to clear. The funeral home must be licensed as an insurance agency and the sales reps are often required to obtain an insurance agent license, which requires hours of classroom time and a requirement to pass the licensing exams.

FULFILLMENTS, CANCELLATIONS AND DEFAULTS

FULFILLMENT: The big difference here centers on a few things. With preneed trust, if the contract is paid in full, in most states the seller can retain all funds received plus trust investment earnings. For insurance, the insurance company or the seller must often return to the estate or family of the insured any amount over the seller’s current prices – unless the purchaser failed to make all payments before the death of the beneficiary. In that case, some insurance policies pay the full death benefit if the policy has been enforced the minimum required amount of time.

CANCELLATION: Trust-funded sellers in most states can retain trust earnings and/or receive a termination fee if a contract is canceled. Neither of those options is available to the seller of insurance-funded preneed contracts.

DEFAULT: Similar to cancellations, many states allow the seller of a trust contract to retain trust earnings, or some portion of funds paid on the contract as a form of liquidation damages if the purchaser defaults. No such remedy exists for insurance contract sellers – and the insurance company could claw back commissions.

SINGLE-PAY VERSUS MULTI-PAY

With trust contracts, the seller generally receives monthly trust earnings on the total amount deposited to trust from day one. For insurance sellers, on the other hand, appreciation is typically credited to the face value of the policy on single-pay and multi-pay contracts from day one. Insurance sellers, however, usually earn more in commission income with multi-pay contracts because of the escalating value of monthly payments over the life of the contract. The discussions about which is better – trust or insurance – have been going on for decades and will continue. This article will give you more information so you can make an informed decision about which funding method best suits your needs.

Comments