(404) 312-6640

Single-Pay Preneed: Are You Leaving Money on the Table?

It is no longer a question of if inflation will continue to increase this year, but how much, which means funeral businesses will need to aggressively manage expenses while simultaneously looking for ways to boost revenue. Improving financial returns on preneed single-pay sales may be just the tonic to blunt the impact of inflation and generate additional revenue, perhaps not immediately, but in the long run.

By now, it’s safe to guess that most funeral businesses have seen the headlines and read the stories about how inflation is at its highest level in 40 years. So far this year, inflation has been running more than 7% on an annual basis. Based on recent forecasts from economic experts, it does not seem likely that it will lessen. What’s more, the war in Ukraine has caused oil prices to skyrocket, which is putting additional upward pressure on our collective wallets.

Our country benefited from low inflation for the past few decades (less than 2.5% annually on average from 1990 to 2020). And our industry has generally been immune from inflation and able to increase merchandise and service prices at least marginally above inflation to protect and/or grow income.

Looking into the future, funeral businesses will need to be proactive in managing costs and pricing, and single-pay sales are a great place to start. Here’s how.

Trust investment returns: the beauty of compounding

Funeral businesses likely are leaving money on the table in the form of investment income from preneed trust assets – income that can offset operating expenses – if they are relying mostly on insurance-funded plans. That’s because trusts generally invest in a portfolio of securities that historically have yielded a better return compared to insurance. In contrast, insurance companies are often required by law to restrict the majority of investments to relatively risk-free investments such as U.S. treasuries and bonds that have a much lower return.

Trust assets typically are invested in a conservative mix of equity and fixed income securities, both of which are subject to short-term market fluctuations. True, growth rates for preneed trust assets are not guaranteed. However, preneed insurance companies generally don’t guarantee their rate of return either. They usually employ what is commonly referred to as discretionary growth, a growth rate declared by the company based on market performance. When looking at market returns over a longer timeframe, preneed trust investments have a significantly better chance of outperforming insurance investments.

A study by mutual fund giant Vanguard (covering the period 1926-2019) found that a balanced portfolio (60% equities/40% fixed income) increased on average 8.8% annually. In comparison, a portfolio of 100% fixed income securities rose 5.5% annually. At first glance, that may not seem like much, but believe me, over the life of a preneed contract the disparity between returns could be the difference of turning a profit on a contract or taking a loss.

Want more proof? In its most recent annual report filed with the Securities and Exchange Commission, the country’s largest operator of funeral homes reported that investment returns for its preneed funeral merchandise and service trust funds were 14.2% in 2021, 16.5% in 2020 and 20.0% in 2019.

Cash flow considerations

A family or individual using trust or insurance will pay only the preneed contract amount for a single installment contract, nothing else. When funding the service with a trust, the payment is made to the funeral home or to the trust and the required percentage is deposited into trust and any allowed retainage is retained by the funeral home. The deposit into the trust is invested and the retainage portion can be used to fund operations. If funded by insurance, the payment goes directly to the insurance company with no retainage.

Insurance-funded contracts allow funeral home operators to earn commission income. Cash flow from sales commissions is more predictable and stable, but, as mentioned earlier, it comes with a price: the funeral home loses out on the opportunity to potentially generate higher investment income from the trust assets.

The bottom line: how trust returns add value

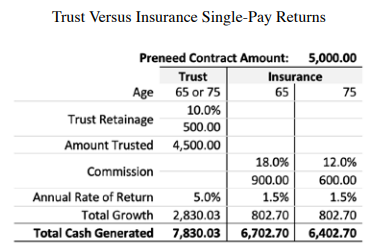

By now you are probably asking yourself, “What’s the bottom line? How will this help our funeral home?” The example below compares financial returns for a trust and insurance preneed contract. In both cases, we use $5,000 as the contract amount and 10 years for the length of time before the contract becomes at need. We also examine the returns on a contract purchased by a 65-year-old and 75-year-old consumer.

For our trust-funded example, we assume that state preneed statutes permit a 10% retainage from the consumer payment. We also assume a compound annual growth rate (CAGR) of 5% – which is far below Vanguard’s historical return on a 60/40 portfolio – on the trust deposit after administrative fees and expenses.

For our insurance funded example, we assume an 18% commission on the 65-year-old and a 12% commission on the 75-year-old. We also forecast a 1.5% CAGR on the face value of the contract for both ages.

Utilizing a trust would generate returns that are 22% higher ($1,428) for a 75-year-old and 17% higher ($1,128) for a 65-year-old compared to an insurance contract. While this example is, of course, hypothetical, based on historical rates of return, the approximate returns are fairly accurate. With most preneed funeral contracts being single pay for the average funeral business, the total returns on these contracts can have a material, positive impact on cash flow over the long term.

Paul White is senior vice president of client development and marketing for FSI. In this role, he is responsible for educating prospective and existing clients about FSI’s products and services and maintaining the highest quality of customer service. He has a 40-year career in at-need and preneed operations and an extensive background in funeral home client development and sales and marketing services.

Comments